Great brokers aim to support their small business clients with fast, professional service. With Business Fuel’s Quick Quote calculator you can find out how much your client can borrow in seconds. By asking your client’s a few simple questions about their day to day working account you’ll have all the info you need.

Ask any small business owner a question about their balance sheet or current profit and loss and they’ll most likely say “speak to my accountant” but ask them about how much they bank per month or how much business is concentrated among their top customers they’ll answer straight away – they’re all over this information as its crucial to the day to day running of their business and gives an immediate pulse check on how things are running.

Business Fuel uses this type of information to assess risk and make lending decisions.

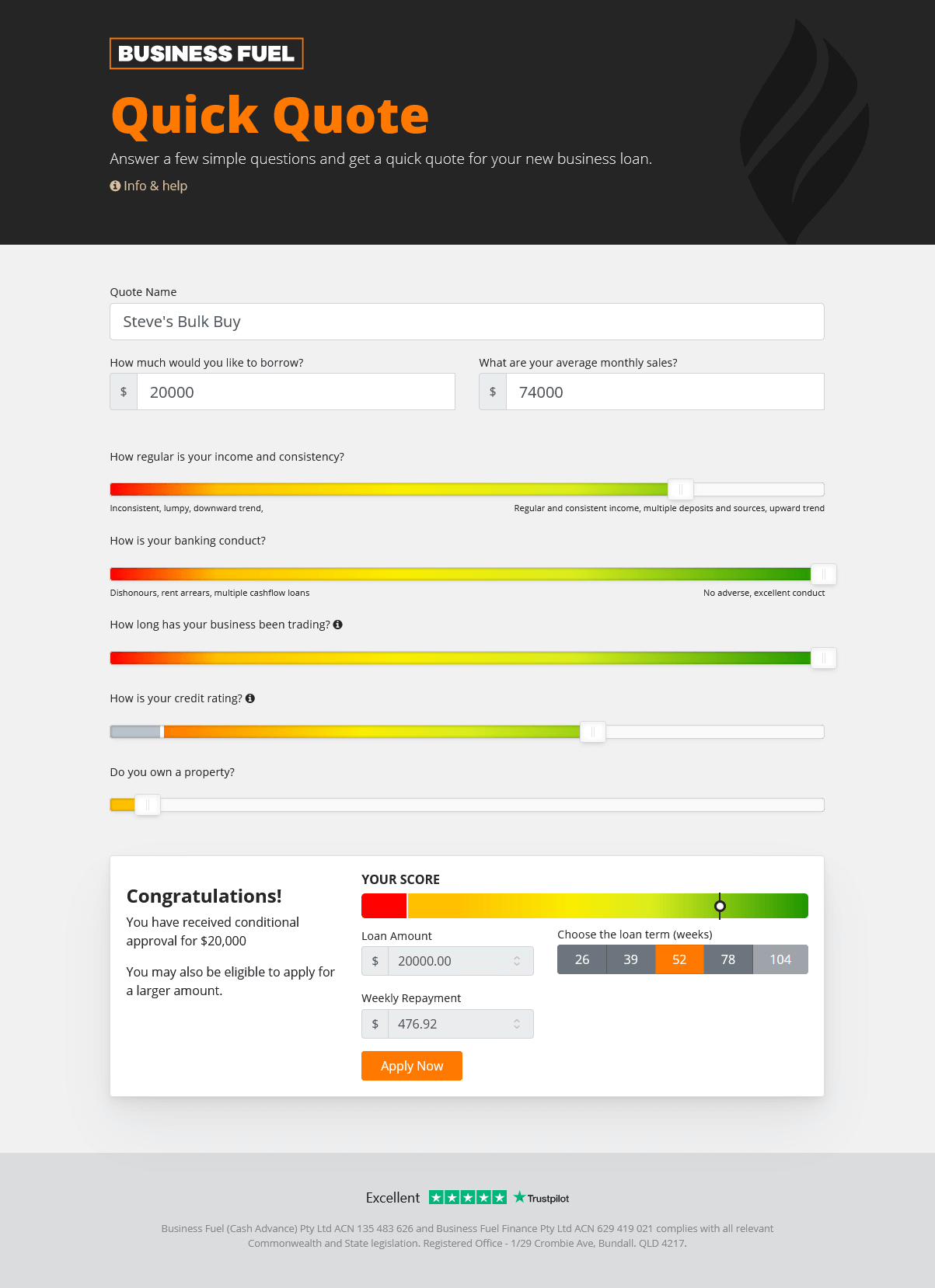

Want to know how much your clients can borrow right now without providing any paperwork? Answer a few questions in our quick quote calculator and you’re a step closer to getting them approved and funded.

Work out your customer borrowing capacity and their weekly repayments within minutes so you can ensure they never miss the next business opportunity due to a delay in funding.

One of our recent customer stories:

Industry: Retail Trade – Water sports equipment

Average Monthly sales: $74,000

Amount required: $20,000

Security: None

Steve ran a successful water sports retail store on the Gold Coast. Leading into the end of year holiday season he had the opportunity to purchase imported stand up paddle boards at a discounted cost price if he purchased them in bulk.

Normally they cost $1,600 and he sells for $2,000 and so makes a profit of $400. He was given the opportunity to purchase these at a discounted price of $1,000 each if he purchased 20 items instead of his normal one or two at a time.

Steve needed $20,000 quickly to take advantage of the opportunity and his broker sent us his application. We quickly funded this, and Steve made the purchase order saving his business a total of $12,000.

As Steve purchased these at a discount, he was able to retail these at $1,600 instead of the $2,000 and undercut the competition for a quick sale. Steve’s profit from these sales totalled $12,000.

Between both the upfront savings of $12,000 and the profit of $12,000 his business quickly generated an additional cashflow of $24,000.

Our loan terms were as follows:

$20,000 loan

$5,000 facility fee

$25,000 total facility paid weekly at $480.77 over 52 weeks

The cost of funds for Steve was $5,000 for him to generate $24,000 in additional cashflow via savings and profit. Our loan facilities do not have any early repayment fees and if Steve paid out his loan early after selling through his stock, we’ll rebate a portion of the facility fee and he’ll improve his position even more.

Broker partners can log in to the Business Fuel Portal now to start using the Quick Quote Calculator. If you are not a partner yet, you can apply to become a broker partner here.